Transaction Explorer

Explorer's transaction tool offers users a wide range of easily accessible reports on sales, taxes, drawer totals, and other financial transactions. The report menu is designed to be organized, relevant, and quick to use, making it an invaluable tool for tracking financial transactions.

Below is a guide on the multiple reports in the transaction explorer menu:

Log in to app.firstchoicepos.com

Click “Transaction” in the Main Navigation menu and select “Transaction Explorer” in the dropdown menu.

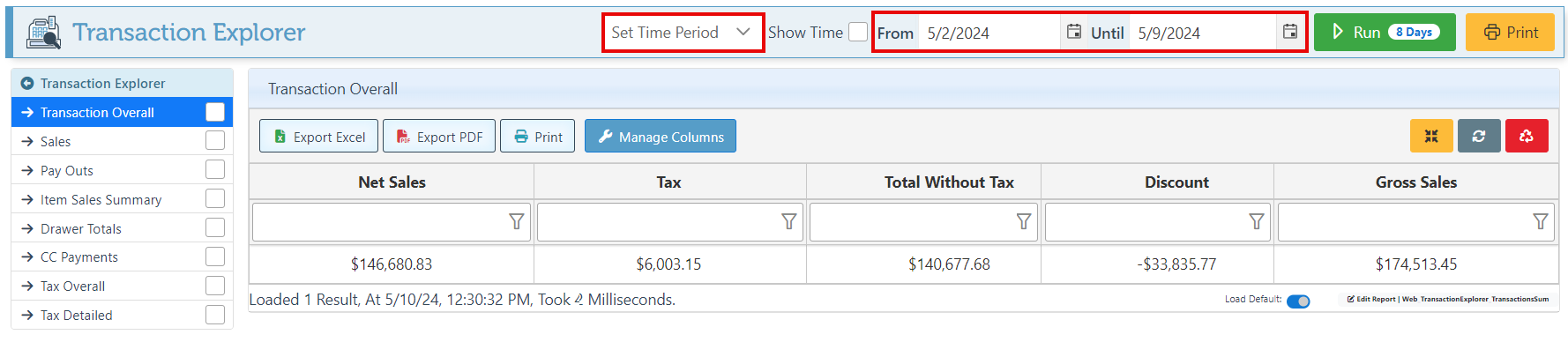

Select a time period in the designated bar (“Always” is currently not supported), or click on the Calendar icons to enter dates in the “From” and “Until” bars to set a specific time period.

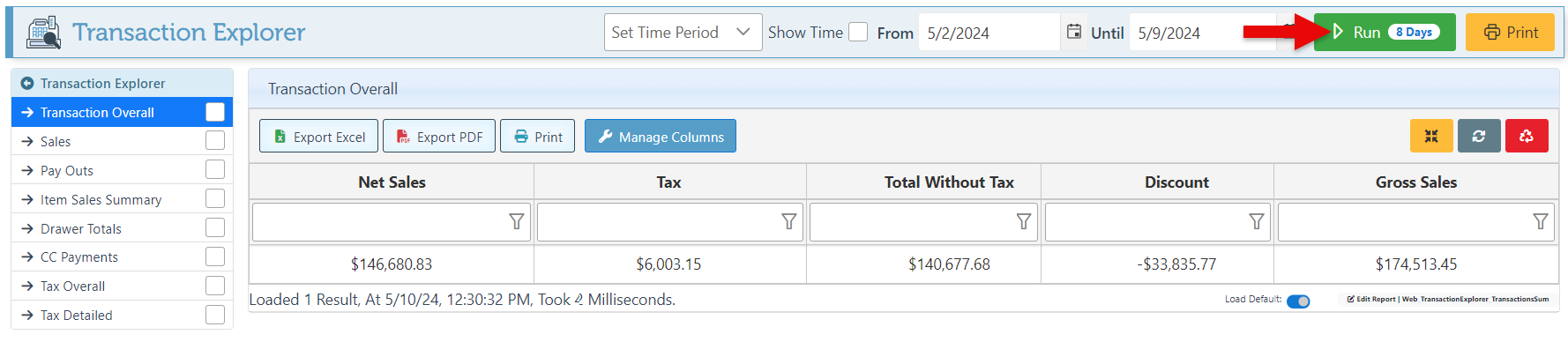

Click “Run” at any time to run and load a report.

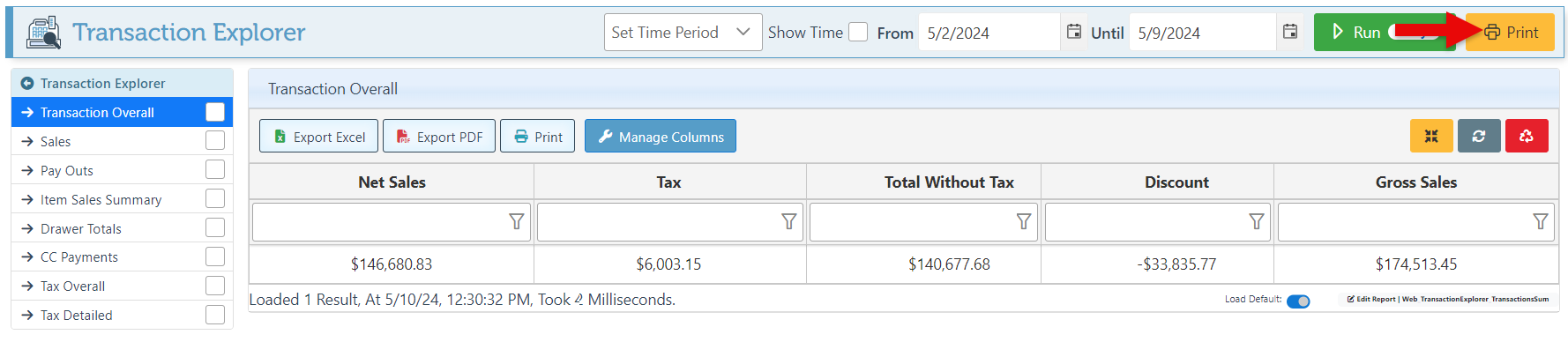

Click the “Print” button at the top right of the page to print the report. The print may include multiple pages to cover scrollable reports.

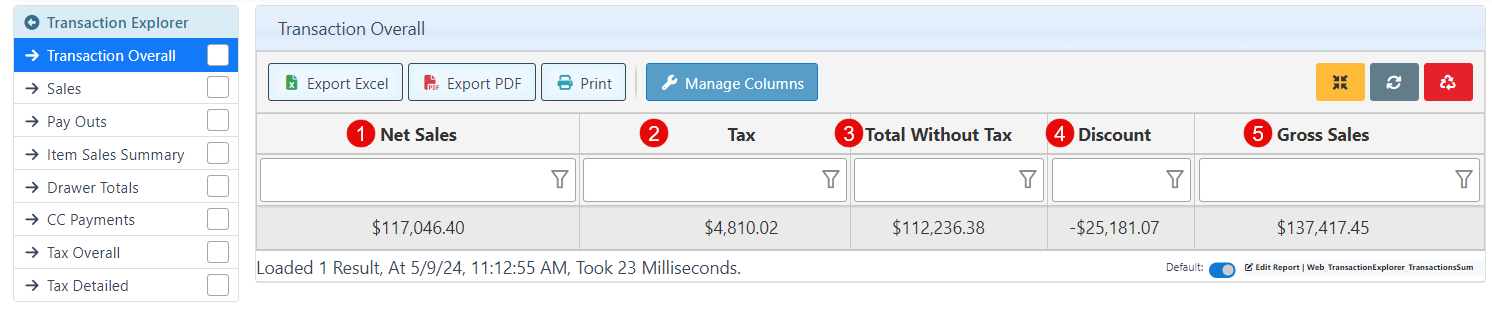

Transaction Overall

Navigate to the “Transaction Overall” tab in the Transaction Explorer menu. This report will show detailed totals of sales, tax, and discounts.

1- Net Sales- Displays total sales, including tax.

2- Tax- Shows total tax collected.

3- Total Without Tax- Displays total with the tax already subtracted.

4- Discount- Displays the total amount deducted from the sales amount as a discount.

5- Gross Sales- Shows the total amount of sales before calculating taxes or discounts.

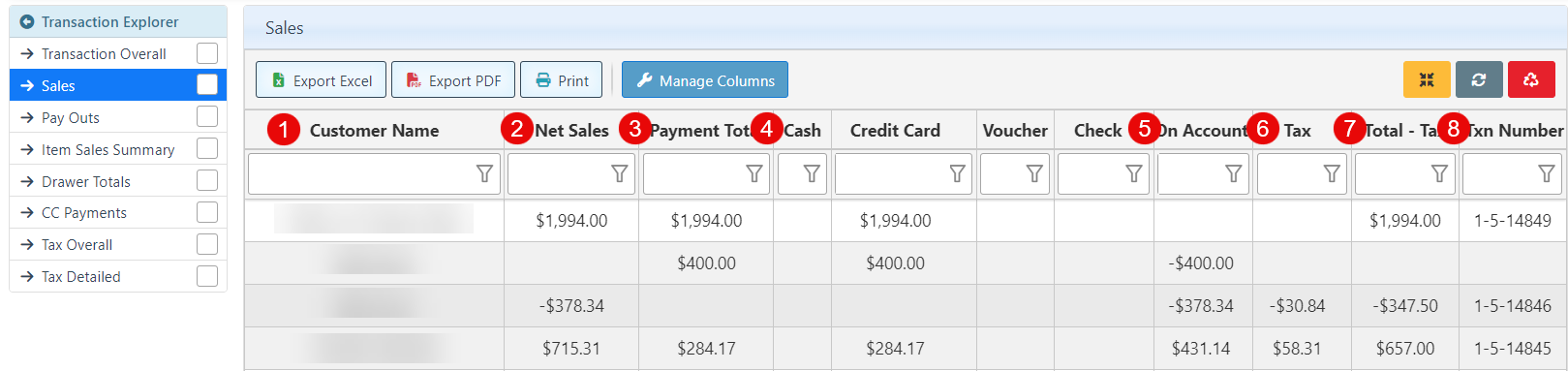

Sales

Navigate to the “Sales” tab in the Transaction Explorer menu on the left. The report will display a detailed sales list, including information such as the customer name, Sale total, and other sale details.

1- Customer Name- name of customer.

2- Net Sales- Sale total, including tax.

3- Payment Total- Total Amount received for sale.

4- Cash, Credit Card, Voucher, Check - The amount received will be displayed in the column of the tender used.

5- On Account- The amount placed on the account to be paid at a later date.

6- Tax- Total tax collected from the sale.

7- Total Without Tax- Displays total with the tax already subtracted.

8- Txn Number- Displays sale transaction number.

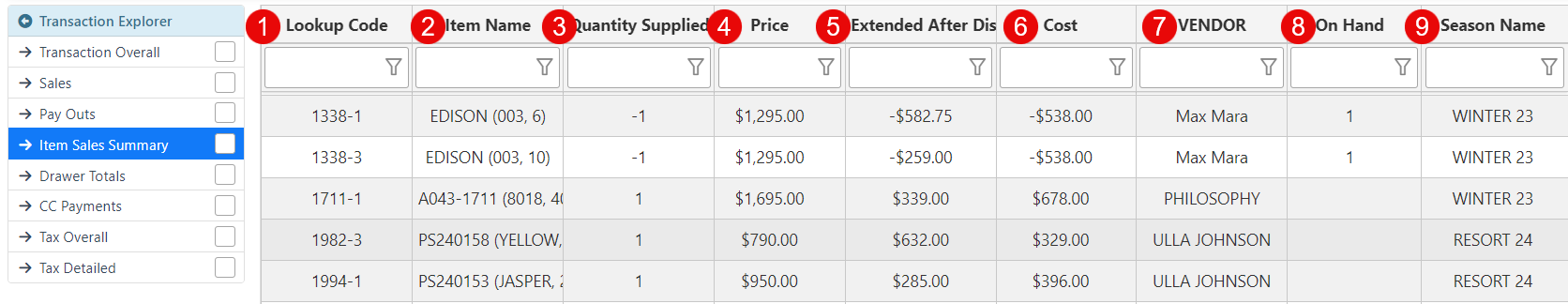

Item Sales Summary

Navigate to the “Items Sales Summary” tab in the Transaction Explorer menu on the left. The report will display a detailed list of items sold, including the quantity, price, and cost.

1- Lookup Code- Displays the item lookup Code.

2- Item Name- Displays the name of the item.

3- Quantity Supplied- The number of items sold.

4- Price- Displays the item price.

5- Extended after discount- Total amount received, with any applied discount already subtracted.

6- Cost- Displays the item cost.

7- Vendor- Name of the Item vendor.

8- On Hand- Amount of items on hand.

9- Season Name- The season the item is categorized as.

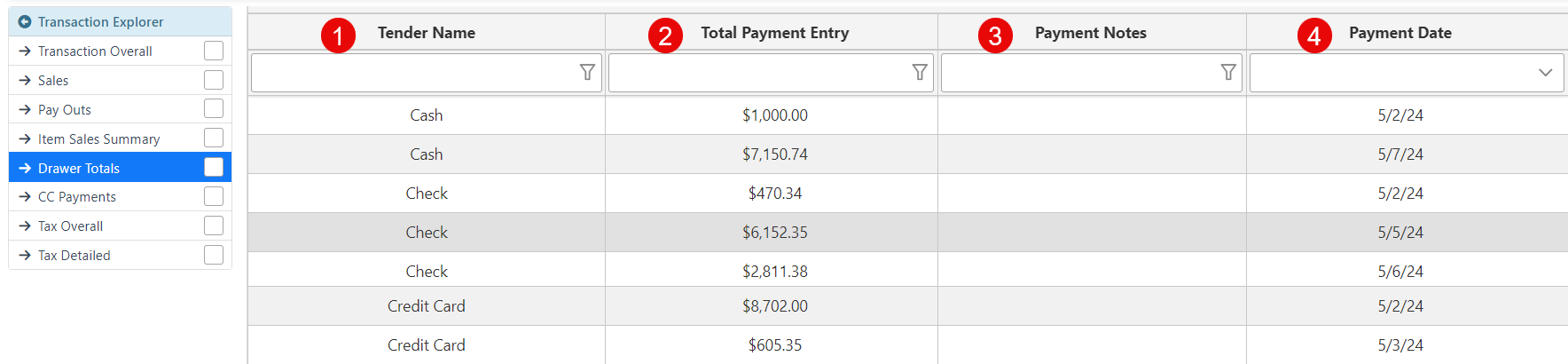

Drawer Totals

Navigate to the “Drawer totals” tab in the Transaction Explorer menu on the left. The report will display the total amount received from each tender per day.

1- Tender Name- Name of tender used.

2- Total Payment Entry- Total amount received through the tender.

3- Payment Notes- Displays any notes added to the payment.

4- Payment Date- Displays the payment date.

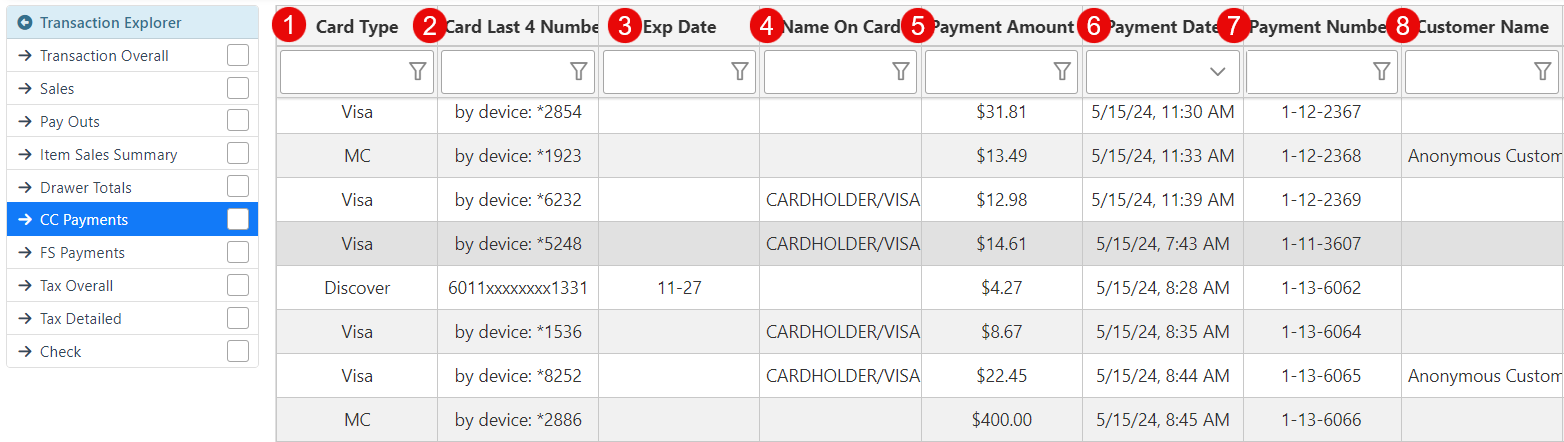

CC Payments

Navigate to the “CC Payments” tab in the Transaction Explorer menu on the left. The report will display all credit card transactions and details for the selected time period.

1- Card Type- Displays the type of card used.

2- Card Last 4 Numbers- Encrypted card number, with only the last 4 digits displayed.

3- Exp Date- Expiration date of the credit card.

4- Name On Card- Name on Credit Card.

5- Payment Amount- Amount paid using the credit card.

6- Payment Date- The date that payment was processed.

7- Payment Number- Displays the payment number of the sale.

8- Customer Name- Name of Customer who paid using the card.

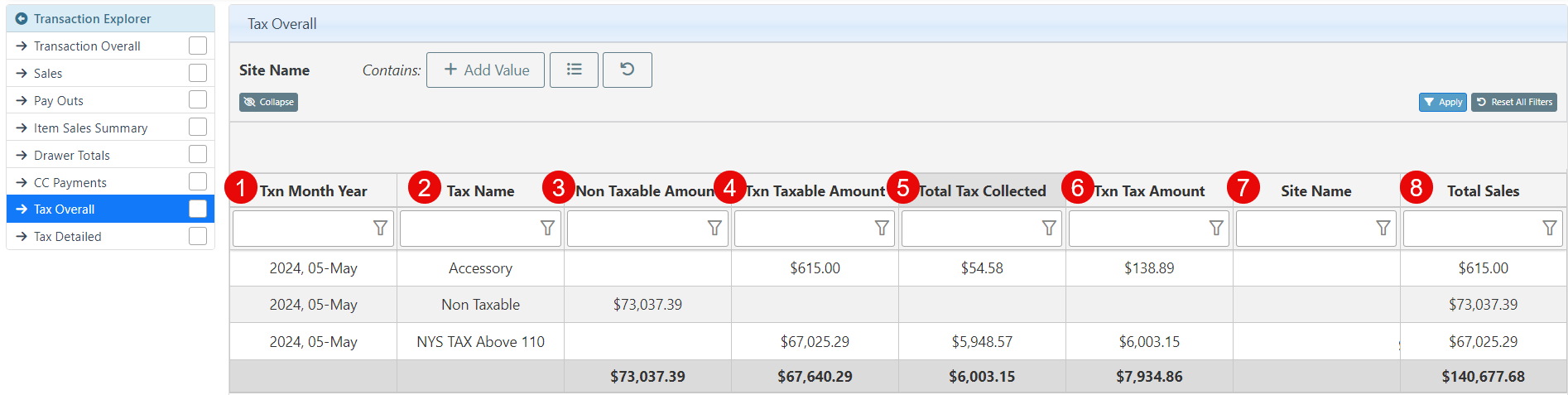

Tax Overall

Navigate to the “Tax Overall” tab in the Transaction Explorer menu. The report will display details and totals for each tax type.

1- Txn Month Year- The month and year during which the tax was collected.

2- Tax Name- Name of the Tax Type.

3- Non Taxable Amount- Total non-taxable sales amount.

4- Txn Taxable Amount- Total taxable sales amount.

5- Total Tax Collected- Total amount of tax collected.

6- Txn Tax Amount- Total Tax required to be collected.

7- Site Name- Name of the site where the Txn was processed.

8- Total Sales- Total amount of sales that fall under the tax type.

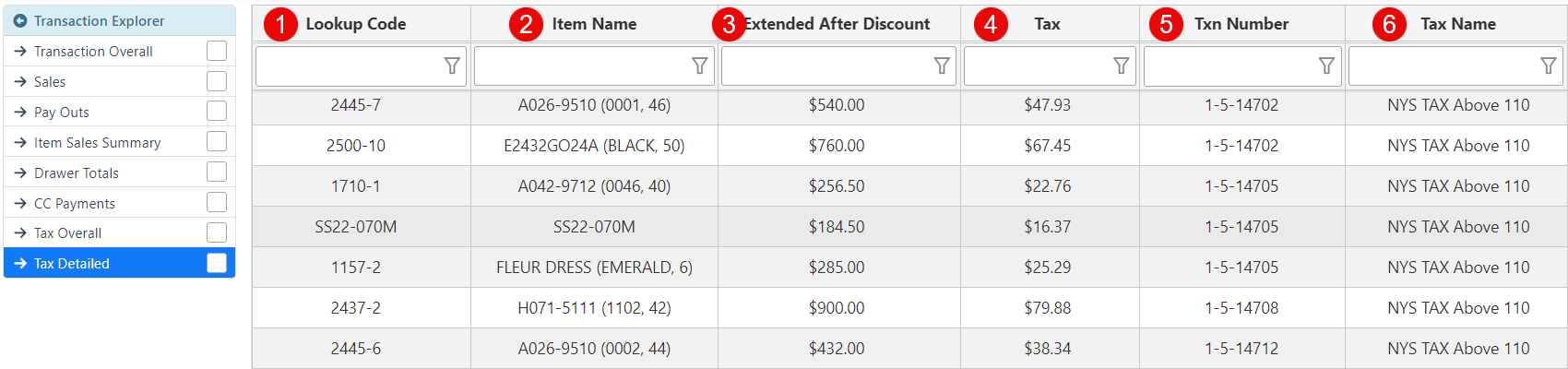

Tax Detailed

Navigate to the “Tax Detailed” tab on the Transaction Explorer menu on the left. The report will display a detailed list of all taxable items sold.

1- Lookup Code-Lookup Code of the taxable item.

2- Item Name- Name of the item.

3- Extended After Discount- Amount received once discounts have been deducted.

4- Tax- Amount of tax collected for the item.

5- Txn Number- The Txn Number in which the tax was collected.

6- Tax Number- Name of the Tax Type.