Create a Tax Payment

Tax payments are records displaying a detailed list of taxable transactions, including essential information such as the total amount of taxable sales and the corresponding tax liability. The tax amount for each transaction is calculated individually and then aggregated, resulting in a clear representation of the overall tax responsibility.

Follow the steps below to create a new tax payment:

Log in to Backoffice.

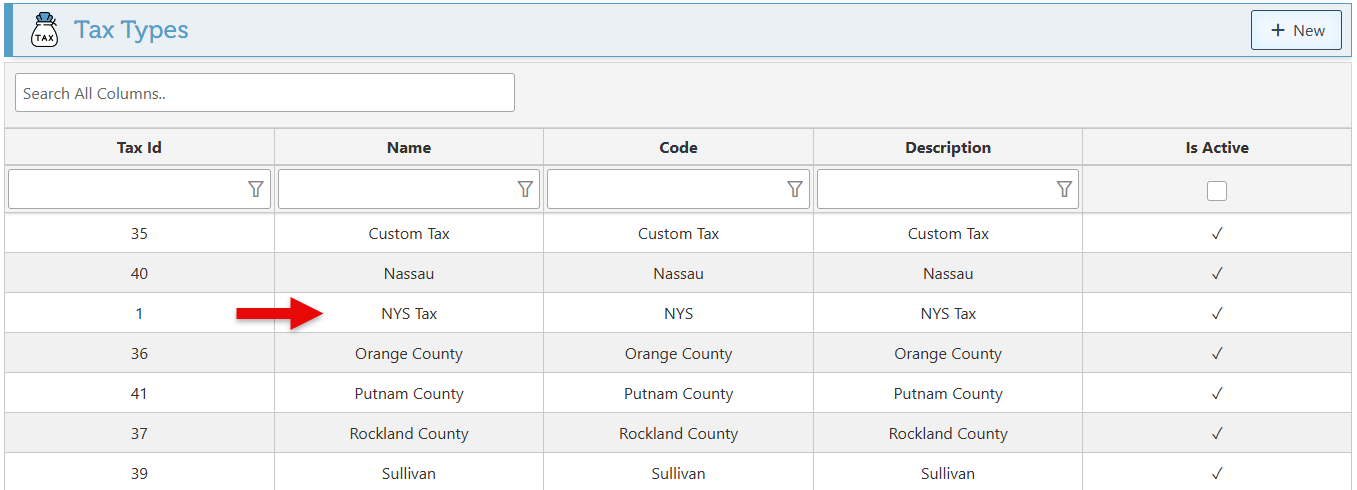

Click “Items” in the Main Navigation menu and select “Tax Types” from the scrollable dropdown.

Click to select the tax type for which to make payment.

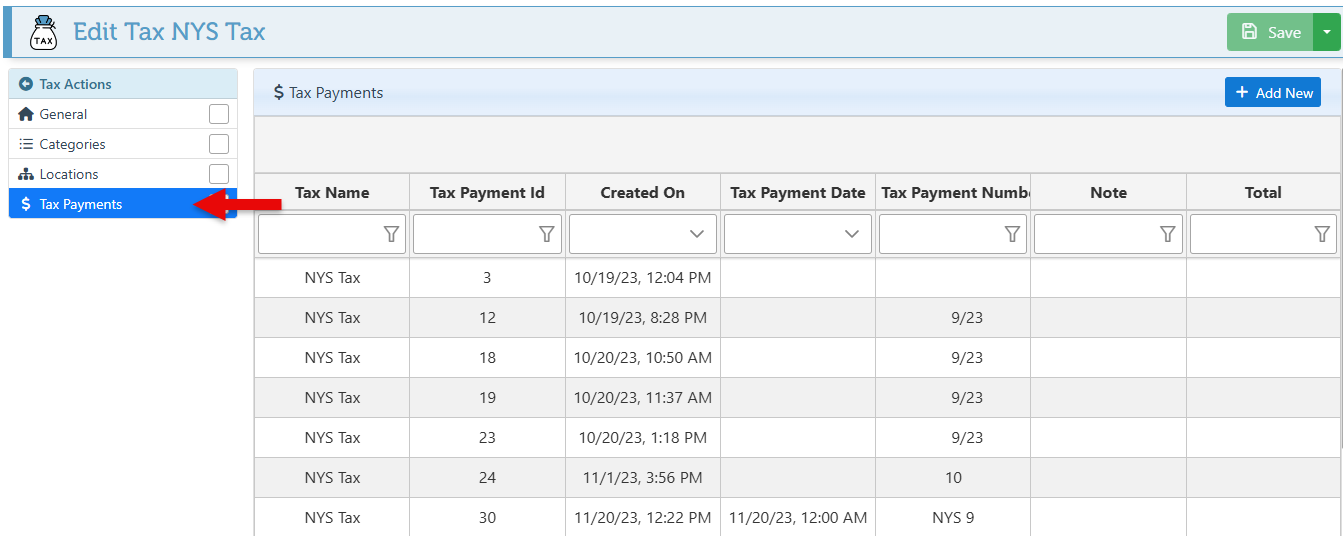

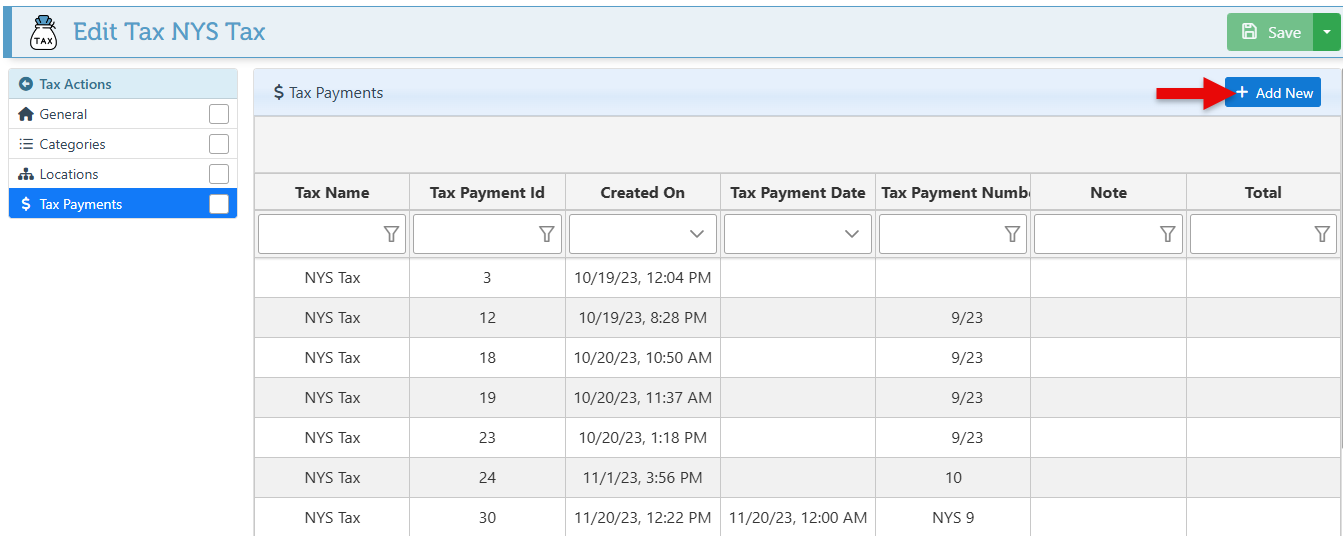

Navigate to the “Tax Payments” tab in the Actions menu on the left to view a list of payments for the selected tax type.

Click “Add New” at the top right to create a new tax payment.

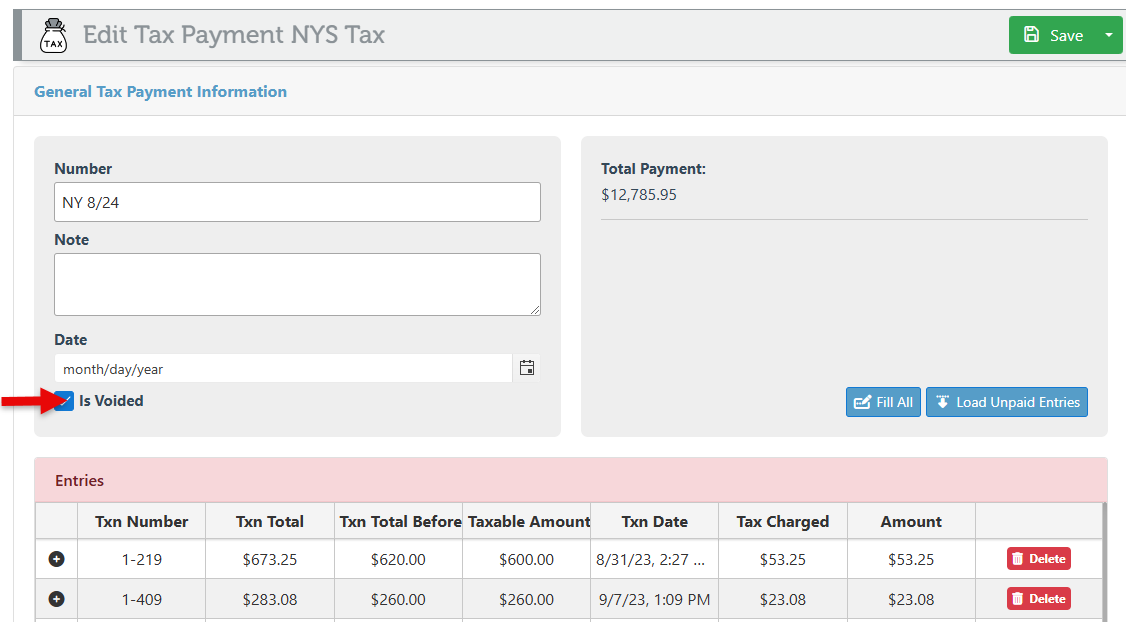

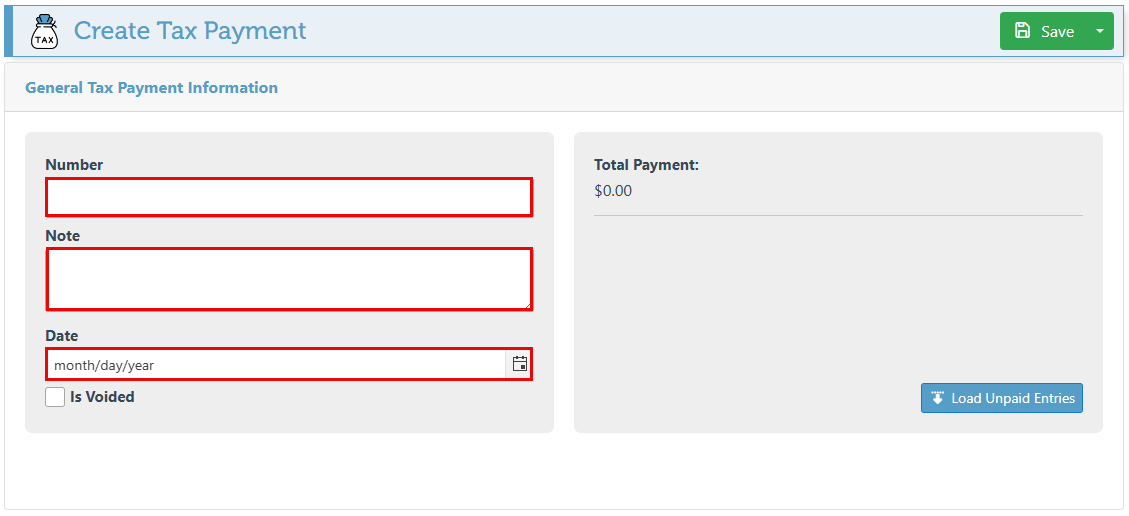

The fields at the top of the page can be used to enter a tax payment number, notes regarding the payment, and the date the tax payment is made.

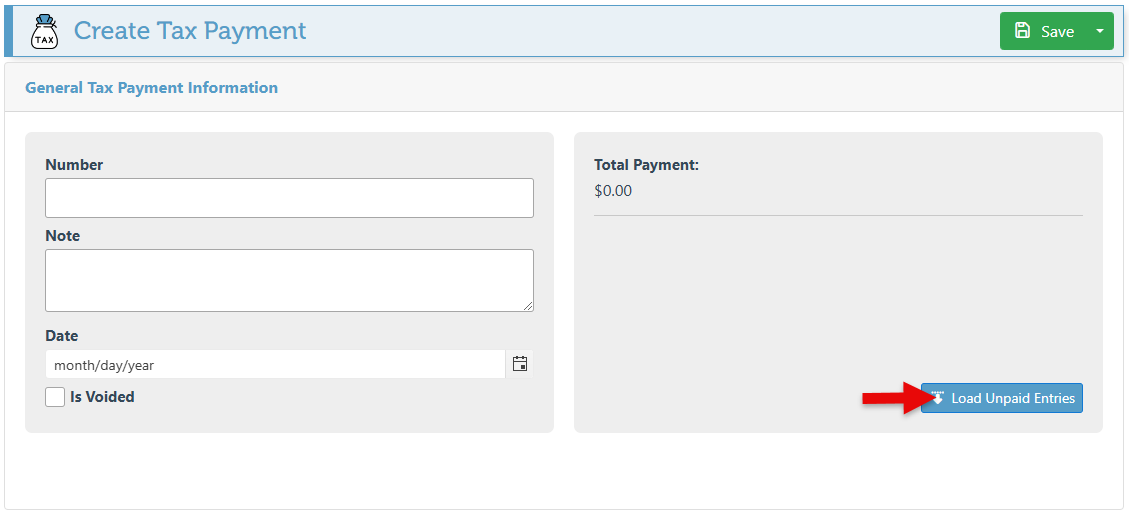

Click “Load Unpaid Entries” to load all tax entries for which tax has not been calculated yet. This will include all transactions for which tax needs to be paid as well as tax credits for events such as returned items for which tax has already been paid.

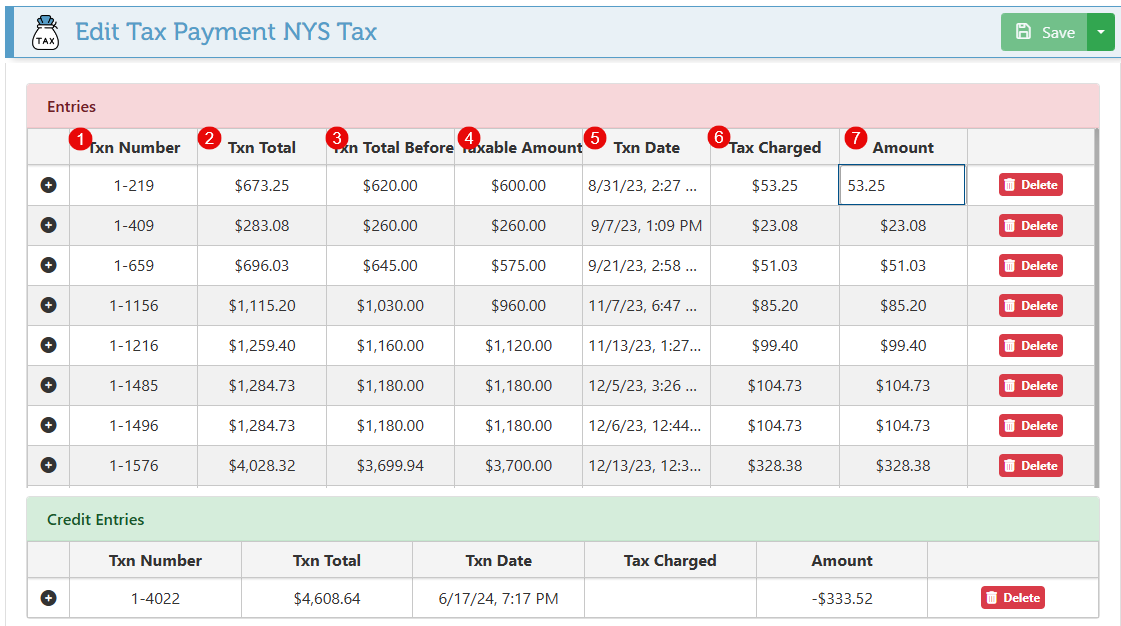

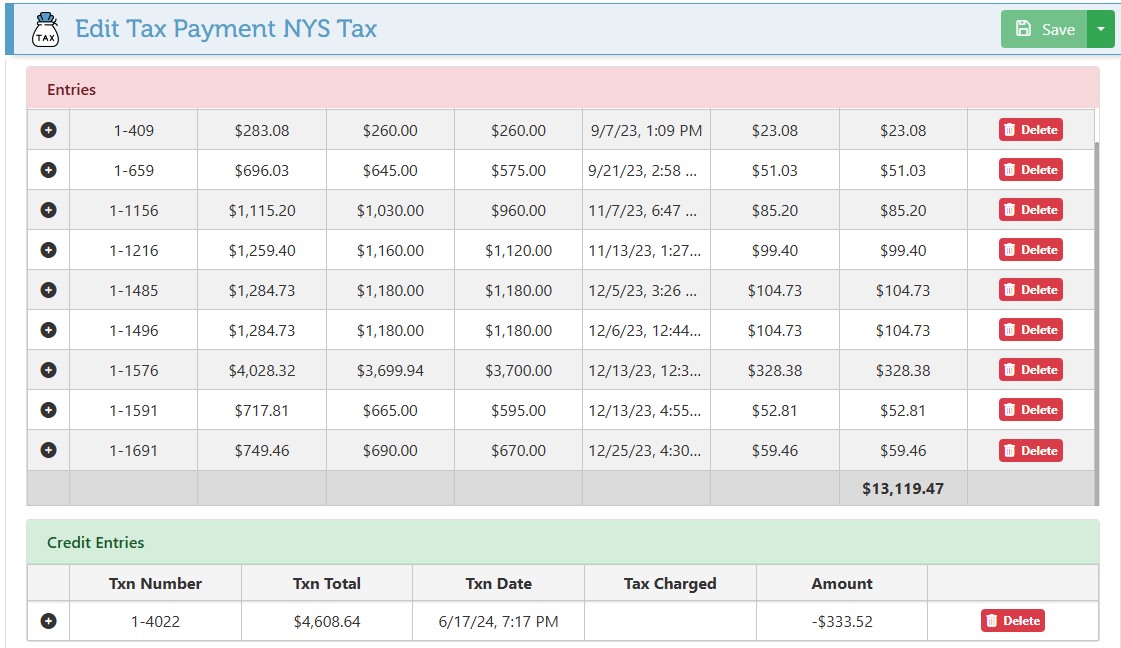

Taxable transactions will be listed with fields including the transaction number(1), total(2), transaction total before tax is applied(3), total taxable amount(4), date(5), tax liability amount(6), and the final tax amount to be paid for the transaction(7). The final tax liability amount field is editable, allowing for adjustments and updates to the final amount being paid for the transaction.

Two grids will appear to provide a clear and separate view of debit entries (for which tax must be paid ) and credit entries (for which a tax credit is to be received. )

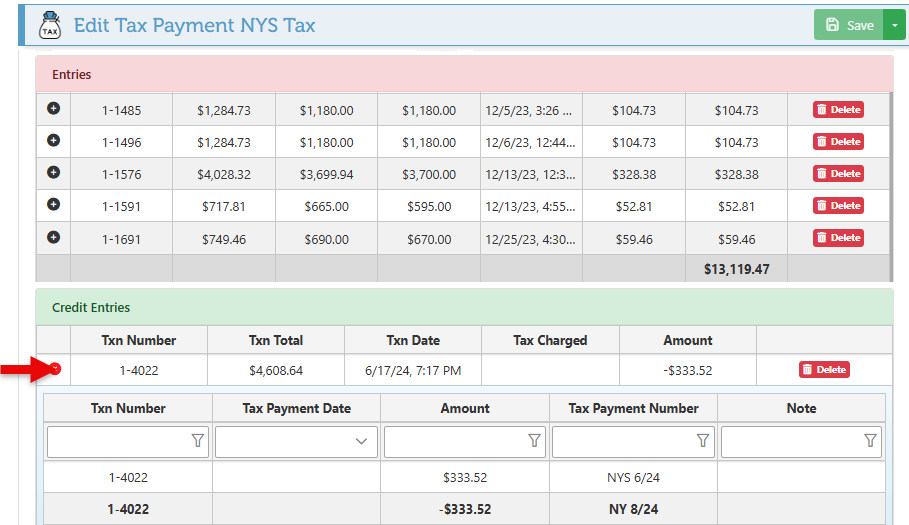

Tax credit entries will include an expandable tab where additional details on the credit can be viewed and verified.

In the payment example below, the expanded tab of a credit entry shows the original payment that was made and the tax credit that will now be received.

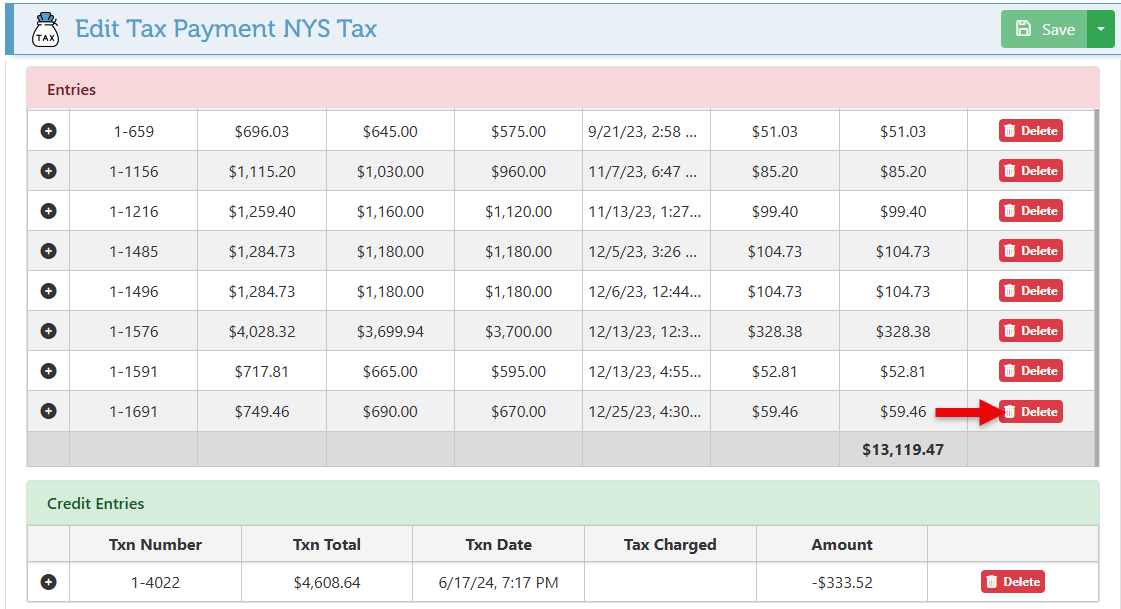

To remove a specific entry from this tax payment, click “Delete.” The tax payment total will update automatically when entries are removed.

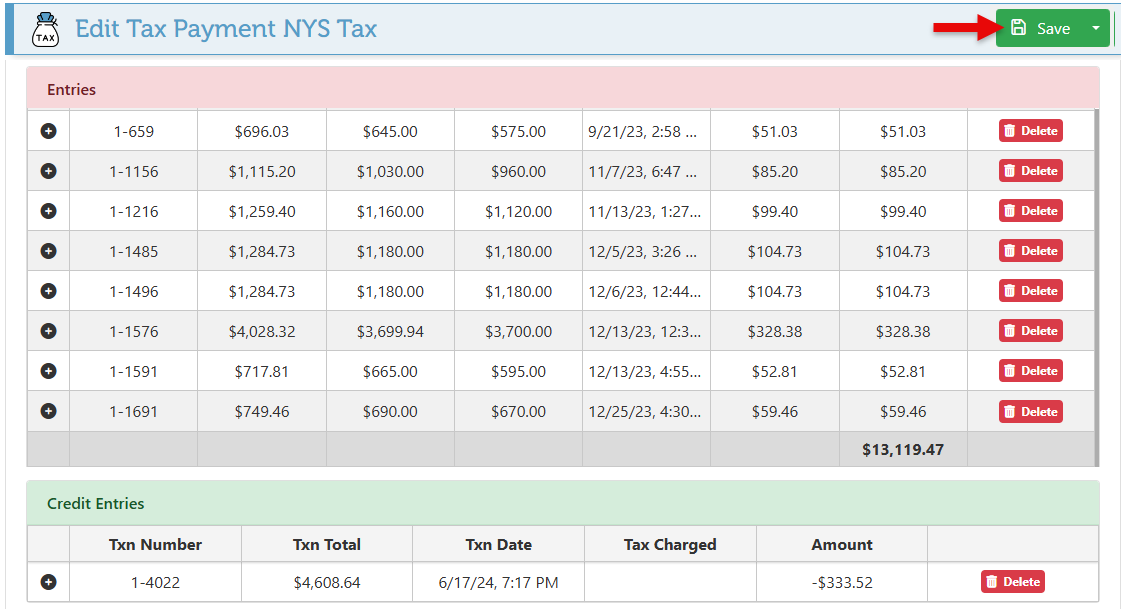

Click 'Save” at the top right to confirm and save the tax payment.

To cancel the tax payment record, check the "Is Voided" box. This will not affect any funds, but disregard this record as though the tax for these items was never paid.